How To Send Money Via Chase Quick Pay

What Is Chase Quickpay With Zelle?

- What Is Zelle?

- Chase QuickPay

- Peer-to-Peer Payment Apps

Monkographic / Getty Images/iStockphoto

The convenience, speed and security of peer-to-peer money transfer apps are here to stay within the financial landscape. An estimated 96 million P2P transactions will take place in 2019 alone, according to eMarketer, a market research company. And banks like Chase have jumped on the bandwagon: In mid-2017, Chase replaced its previous Chase QuickPay app for a new Zelle-powered offering, called Chase QuickPay with Zelle. When you bank with Chase, you can leverage this partnership between Chase and Zelle to quickly and easily transfer money to family and friends — for free.

What Is Zelle?

Zelle is a service that lets you make payments and receive money, either through the Zelle app or through participating bank apps. It is utilized by several financial institutions to compete with the standalone Venmo app, with a focus on being used within a bank's own mobile app. Zelle's security features ensure that Chase QuickPay with Zelle transactions are safe, and recipients who don't already have an account at a participating financial institution can quickly sign up for a Zelle account to access the funds they receive.

Note that Chase QuickPay with Zelle is different from Chase Pay, which allows a customer to make payments using their phone at participating retailers and to redeem their Chase Ultimate Rewards points for a statement credit.

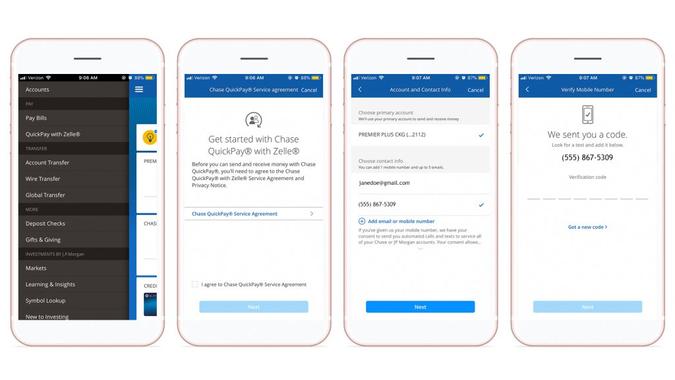

How To Set Up Chase QuickPay With Zelle

You need a Chase checking account to use Chase QuickPay with Zelle, and you must have a Chase.com login. Once you meet those requirements, you can enroll in Chase QuickPay with Zelle by following these steps:

- Sign in to the Chase website with your username and password. You can enroll on the website before continuing with the Chase QuickPay with Zelle process if you don't already have an account.

- Select the "Chase QuickPay with Zelle" from the "Pay & transfer" menu.

- Review and accept the Chase QuickPay service agreement and privacy notice.

- Verify your email address or mobile phone number via the one-time code that Chase will send to you.

- Select the checking account or Chase Liquid card you wish to use to make your Chase QuickPay with Zelle payment.

- Once you've completed the steps, you're ready to request, receive and send money.

How To Send or Request Money Using Chase QuickPay With Zelle

Chase customers can access Chase QuickPay with Zelle through the Chase mobile banking app. To send money, simply enter the email address or mobile phone number of the person you wish to pay and the amount you're sending. Send money to or request money from anyone by following these five simple steps:

- Sign in to the Chase Mobile app.

- Select either "Send Money" or "Request and Split Money" in the "QuickPay with Zelle" tab of the navigation menu.

- Choose an existing recipient from your contacts or add a new one.

- Check the payment information for accuracy.

- Tap "Send Money" or "Request Money."

You'll receive a confirmation that the transaction was successful, and the recipient will receive instructions on how to complete the process and claim the money. If you're requesting money, the party on the other end of the transaction will get a notification.

Timing for Payments

When you send a payment to someone using Chase QuickPay with Zelle, it's helpful to know when the payment might arrive:

- For recipients with a Chase account, the money usually arrives within minutes, but no later than the next business day.

- For recipients who bank at a different Zelle member bank that supports real-time payments, the transaction typically takes only minutes. Otherwise, the funds are available within one to two business days.

- For recipients who bank at a financial institution that is not a Zelle member, funds should be available within one to two business days, depending on the bank's processing times.

- Recipients who are using the Zelle app will get the money soon after it's sent, according to Chase.

For assistance with Chase QuickPay with Zelle, call 877-242-7372 in the U.S. or 713-262-3300 outside the U.S.

Sending Limits for Chase QuickPay With Zelle

Chase QuickPay with Zelle transfers money electronically to and from your bank account. Although you're able to receive unlimited amounts of money, there are some limits on what you can send:

- Chase personal checking account or Chase Liquid card: The limit is $2,000 per single transaction, up to $2,000 in one day, and no more than $16,000 in a calendar month.

- Business checking accounts:Single transactions are limited to $5,000, up to $5,000 in one day, with a $40,000 cap per calendar month.

- Chase Private Client and Private Banking client accounts: Single transactions are limited to $5,000, up to $5,000 in one day, with a $40,000 cap per calendar month.

Chase QuickPay with Zelle is free for both sending and receiving money. The only charge is any applicable data usage or message fees imposed by your mobile carrier.

One important distinction between the Chase QuickPay app that's powered by Zelle and Chase Online Bill Pay is that Zelle is only meant for peer-to-peer transactions. To schedule one-time or ongoing payments for expenses like rent, utilities, car payments and credit card bills, you must use the bill pay service.

Tips for Safely Using Peer-to-Peer Payment Apps

Chase QuickPay with Zelle isn't the only peer-to-peer payment app — and it's certainly not the first. That designation would go to PayPal, which has been around since December 1998. In the two-plus decades since PayPal made its debut, plenty of other P2P payment apps have cropped up: Venmo (which is a subsidiary of PayPal), Cash App, Apple Pay and Google Pay are all players in the P2P payment game. You can even make peer-to-peer payments via Facebook Messenger. In today's world, there's really no excuse not to split the bill the next time you're out for lunch with friends. With so many options out there, it's important to consider the potential risks of using these payment apps.

When you send money via P2P apps, you must be diligent about sending the money to the right person. Always double- or triple-check the contact information of the person you are sending the money to. You might also want to let them know in advance that you're sending funds their way. Before you tap the "Send Money" button, make sure you're sending the correct amount. It's not outside the realm of possibility to accidentally send $1,000 rather than $10.

The Chase website offers this disclaimer: "Make sure you send money to people you know and trust in order to avoid scams and protect your account. We don't protect or cover purchases if you use QuickPay to pay for goods or services."

Keep reading to find out how to locate your nearest Chase branch.

Erika Giovanetti contributed to the reporting for this article.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone and have not been endorsed by American Express.

Editorial Note: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are author's alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

About the Author

Barb Nefer has been writing professionally for nearly 30 years, cutting her teeth as a news writer for the Daily Southtown in Chicago. She's a doctor of psychology, and her eclectic expertise includes personal finance, psychology, travel and the pet industry. Her work reflects that diversity, with pieces appearing in places like About.com, CBS Local, Yahoo.com, WebPsychology, and Animal Wellness magazine.

Check Out Our Free Newsletters!

Every day, get fresh ideas on how to save and make money and achieve your financial goals.

How To Send Money Via Chase Quick Pay

Source: https://www.gobankingrates.com/banking/mobile/what-is-chase-quickpay-zelle/

Posted by: olszewskifordece.blogspot.com

0 Response to "How To Send Money Via Chase Quick Pay"

Post a Comment